The fertiliser producer Incitec Pivot states in Australian Farm Journal that they are fully dependent on phosphate from occupied Western Sahara.

The story below appeared in Australian Farm Journal, 1 July 2009.

Download the article here: page 6, page 7, page 8.

The problem of Western Sahara rock phosphate

Western Sahara is located in northern Africa, bordering the North Atlantic Ocean, between Mauritania and Morocco. It is a very arid area but is rich in phosphates in the Bou Craa region. Consequently, Western Sahara is the world’s largest supplier of quality phosphate rock, with reserves of around 5700 million tonnes. Even the US, which has reserves of just over 1000 million tonnes, imports rock from Western Sahara, an area controlled by Morocco which has occupied the region since 1975.

The official status of Western Sahara is a as a “non-self-governing territory”, according to the United Nations. The government in exile, the Sahrawi Arab Democratic Republic, disputes Morocco’s control of the territory. Morocco has been repeatedly criticised for its actions in Western Sahara by international human rights organisations such as Amnesty International, Human Rights Watch and the World Organization Against Torture. Many of the nomadic indigenous people, the Sahrawis, fled under bombardment to refugee camps in south-western Algeria, and the government has encouraged Moroccan citizens to relocate to the territory, creating a state-dominated economy with the government as the single biggest employer. The Moroccan state phosphate company, OCP, has a facility at Bou Craa, connected by an enormous conveyor belt which transports the phosphate rock 100 kilometres to El Aaiun harbour.

Trading with Morocco for phosphate rock has been condemned by the UN, and several Scandinavian countries have considered boycotting imports from Morocco. Both IPL and CSBP source some of their phosphate rock from Morocco, and a spokesperson for the Department of Foreign Affairs and Trade (DFAT) says Australia does not ban the importation of phosphate from Western Sahara.

“The UN has not imposed restrictions on the trade (in the form of UN Security Council sanctions) and we are not aware of any country which maintains autonomous sanctions against the trade”, she says. “However, we are conscious of the status of Western Sahara as a non-self-governing territory. DFAT draws on companies’ attention to the international law considerations involved in importing national resources sourced from Western Sahara and recommends that companies seek legal advice before importing such material”.

IPL says there is currently no alternative source for the high-grade phosphate rock imported from Morocco to manufacture single superphosphate (SSP) to Australian standards. “All Australian SSP producers use some rock from Western Sahara,” Neville Heydon says. “Without rock from the region, it is unlikely that Australian manufacturers could produce the one million tonnes of SSP farmers require each year to maintain productivity and international competitiveness. IPL’s ability to maintain production at its SSP plants would also be in doubt”.

CSBP sources the majority of its phosphate rock from Western Sahara “as its properties enable CSBP to continue manufacturing SSP and meet its rigorous environmental and quality standards,” says managing director Ian Hansen.

“Wesfarmers and CSBP have engaged in dialogue with opponents of the import of phosphate rock trough Moroccan-based supplies from Western Saharan deposits, including Kamal Fadel, Polisario representative to Australia. We continue to monitor the United Nations’ efforts to resolve the dispute over Western Sahara”.

The Australian Western Sahara Association says the trade in phosphate sourced in Western Sahara but sold by Morocco should be put on hold until the conflict over Western Sahara is resolved.

“So long as Morocco is able to exploit the natural resources of the country it occupies it has no motive to settle the issue,” Cate Lewis, who is also international co-ordinator for Western Sahara Resource Watch, says.

“If the three Australian phosphate importers acted together they would have quite a significant effect on Morocco, - even more so if they teamed up with the two importers in New Zealand. Morocco desires international respectability openly so we think it would be a worthwhile action.”

She says farmers can put pressure on the Federal Government and the fertiliser manufacturers. “If Australia was to impose a trade embargo on the product it would certainly make it easier for the fertiliser companies.

“If a farmers’ group was to insist that Australia boycott this phosphate trade it would certainly help persuade the government, I should think, because one of the reasons it is loath to act is that it doesn’t want to upset the farmers. It would be a great gesture if the farmers took the initiative here.”

New report: Western Sahara phosphate trade halved

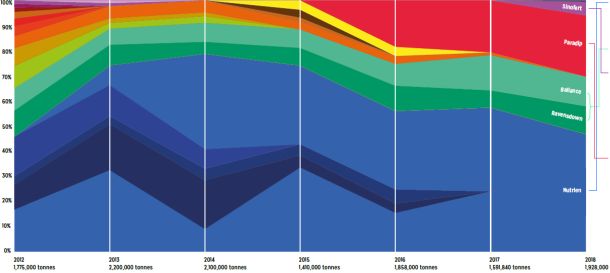

The export of phosphate rock from occupied Western Sahara has never been lower than in 2019. This is revealed in the new WSRW report P for Plunder, published today.

New report on Western Sahara phosphate industry out now

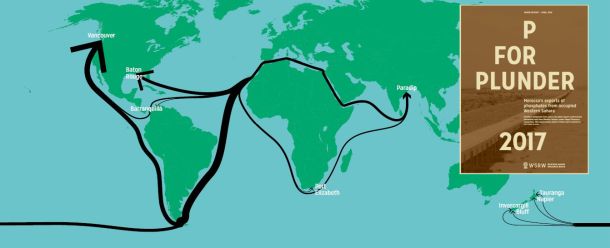

Morocco shipped 1.93 million tonnes of phosphate out of occupied Western Sahara in 2018, worth an estimated $164 million, new report shows. Here is all you need to know about the volume, values, vessels and clients.

New report on contentious Western Sahara phosphate trade

Morocco shipped over 1.5 million tonnes of phosphate out of occupied Western Sahara in 2017, to the tune of over $142 million. But the number of international importers of the contentious conflict mineral is waning, WSRW's annual report shows.

New report on global phosphate trade from occupied Western Sahara

Over 200 million dollars worth of phosphate rock was shipped out of occupied Western Sahara last year, a new report from WSRW shows. For the first time, India is among the top importers.