Agrium looks to other sources than Western Sahara

The biggest purchaser of phosphate rock from occupied Western Sahara has said its purchase agreement is only a temporary solution, and that it hopes to find phosphate rock elsewhere.

Published 11 April 2017

"This supply agreement was always viewed as an interim arrangement while we looked at other alternate sources of rock and also longer term arrangements which may include internal ones", Agrium's Vice President, Investor/Corporate Relations and Market Research, Mr. Richard Downey, wrote in a letter to Western Sahara Resource Watch 30 March 2017.

Later this month, Western Sahara Resource Watch (WSRW) will launch its annual report on global phosphate purchases from the territory, analyzing the data of the 2016 bulk vessel ship traffic.

The report will show that Agrium - again - is the most important purchaser of such controversial rock. The rock is exported by the Moroccan state owned phosphate company OCP, against the wishes of the people of the territory.

"Agrium entered into a phosphate rock supply agreement with OCP when our mine in Kapuskasing, Ontario, Canada, reached the end of its economic life and with the longer-term view of keeping our processing facility at Redwater, Alberta, Canada operational", the company wrote to WSRW.

From what Western Sahara Resource Watch understands, the intention of purchasing Western Sahara rock as only an interim solution to its supply shortages, has been communicated to investors for a few years now.

A large number of investors in Europe have divested from Agrium's competitor PotashCorp. The reason this has not happened with Agrium is partially because the latter company has been able to convince its owners that it is looking for other sources. Only a dozen of the responsible investors with public exclusion lists have so far made clear they have blacklisted Agrium from their portfolios.

"The production of phosphate fertilizers from various rock sources provides a number of chemical and industrial challenges especially when considering the design and age of the processing facility. We continue on with this work, including in the context of our proposed merger with PCS that may provide an alternate source of phosphate rock for Redwater. However, as you know this merger is not final and still requires regulatory approvals in several jurisdictions along with meeting the terms of the merger agreement. Saying that, we are encouraged by our progress to date", Agrium wrote.

As the two companies will merge later this year, it is expected that investors will automatically implement the exclusion of PotashCorp onto the new, merged company. The Agrium statement did not elaborate on how the merged company would address the purchases of PotashCorp that is imported into Louisiana, USA.

On 21 December 2016, the Court of Justice of the EU found the EU trade agreements with Morocco not to be applicable to the territory, and that the representatives of Western Sahara need to consent for trade to be legal. The trade deal also underlined the ability of the national liberation movement of Western Sahara to take on, and win, legal cases. Agrium has never responded to questions on Saharawi consent.

News

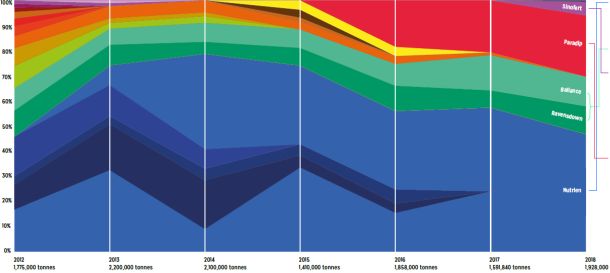

New report: Western Sahara phosphate trade halved

The export of phosphate rock from occupied Western Sahara has never been lower than in 2019. This is revealed in the new WSRW report P for Plunder, published today.

24 February 2020

New report on Western Sahara phosphate industry out now

Morocco shipped 1.93 million tonnes of phosphate out of occupied Western Sahara in 2018, worth an estimated $164 million, new report shows. Here is all you need to know about the volume, values, vessels and clients.

08 April 2019

Nutrien maintains Western Sahara link via China

Nutrien - until now the biggest importer of phosphate rock from Western Sahara - has ended its trade. But what about the stock-exchange registered Sinofert Holdings in which they are the second biggest owner?

27 January 2019

US imports of Western Sahara conflict rock to end

A landmark decision has been made. The large-scale exports of conflict phosphates from occupied Western Sahara to the United States will stop this year.

13 September 2018