IPL claims not responsible

Australian phosphate importer Incitec Pivot said at its recent Annual General Meeting that the UN is responsible for the Western Sahara issue, not the company. Simultaneously, they defended their imports which are taking place in violation of the UN\'s legal opinion and over 100 UN resolutions.

Published 27 December 2009

Australian phosphate importer Incitec Pivot said at its recent Annual General Meeting that the UN is responsible for the Western Sahara issue, not the company. Simultaneously, they defended their imports which are taking place in violation of the UN's legal opinion and over 100 UN resolutions.

The issue of imports from Western Sahara, which is taking place in disregard of the Sahrawi people, and thus is in violation of international law, was raised on the Incitec Pivot annual general meeting on 23 December 2009.

Incitec Pivot's chairman John Watson stated they believe the trade is legal, and that it "is not an issue for us to resolve".

"The matter is being taken before the United Nations, and to the extent they take an interest in that matter, they are the ones that are responsible for resolving it", Watson stated.

Incitec Pivot is working against the UN legal opinion from 2002. More than 100 UN resolutions have been passed supporting the Sahrawi people's right to self-determination.

By buying phosphate from the occupying power Morocco, Incitec Pivot undermines this right that the UN established.

IPL still believes "that we do operate ethically as a company". Several ethical international investors have divested from IPL due to their unethical imports and undermining of international law.

Incitec Pivot expects to meet forecasts

23/12/2009 5:48:13 PM

Explosives and fertiliser supplier Incitec Pivot Ltd says its first quarter results so far show its businesses are performing to expectations.

Chief executive James Fazzino told shareholders at the company's annual general meeting on Wednesday that the group is looking to the future with confidence after a tough year marked by earnings declines and writedowns.

"We made progress across a range of areas, ensuring that we came out of the financial and market storms of 2009 better placed to weather the challenges of 2010," he said.

"In relation to the 2010 year, we normally don't get a strong indication of the likely direction of the year until the second quarter.

"However, the results for the first quarter, so far, show that our businesses are performing as expected."

Mr Fazzino also said he would update investors on Incitec's development of an ammonium nitrate plant at Moranbah in central Queensland before the end of March next year.

In February, Incitec announced it would slow construction of the project for 12 month due to expectations of slowing demand for ammonium nitrate from the Queensland coal industry.

Incitec reported a $179.9 million loss in fiscal 2009, mainly due to a $491 million non-cash writedown of goodwill for its Dyno Nobel global explosives business .

Chairman John Watson told shareholders that the writedown did not mean Dyno Nobel, which Incitec acquired in mid-2008 for about $3.3 billion, was not performing to expectations.

"This reflects the current cyclical softness in the US economy," Mr Watson said.

Mr Fazzino told reporters after the meeting that Incitec expects sales volumes of explosives in its North American market to be flat over fiscal 2010, although earnings will improve as a result of greater efficiency.

The Dyno Nobel explosives business derives 70 per cent of its earnings from North America.

But sales of explosives have been affected by the economic slowdown there and the consequent impact upon mining.

"What we would expect would be the volumes to be flat, which is consistent with the economy," Mr Fazzino said.

"What we've said is we'd expect a soft first half and a better second half."

Mr Fazzino said earnings in the US explosives business would be driven by savings generated by the group's Velocity efficiency program.

"So, flat top line and improvement in the bottom line because of Velocity," he said.

He said Incitec Pivot expected some growth in explosives volumes in the Australian market.

"That's also partly because we've got some new contracts," he said.

"That reflects very consistently what we're seeing in Australian mining. When mining volumes go up, explosives volumes go up."

Mr Fazzino said Incitec Pivot also expected global volumes for fertiliser would pick up a little over fiscal 2010.

"There is no free lunch in fertiliser," he said.

"The world has had quite a good crop this year, not withstanding the fact that there were large pull-backs in fertiliser use.

"So it would be the expectation of the industry that we would see improved application rates this year.

"In terms of fertiliser prices, they're just difficult to call and we've stopped predicting where they'll go."

The Incitec board was again quizzed by shareholders over the sourcing by the company of phosphate rock from Western Sahara.

One shareholder said Western Sahara was occupied by Morocco, and the occupier was selling the phosphate that belonged to another people.

The shareholder said this was against international law unless the indigenous people consented to the sale and benefited from the sale.

Mr Watson said Incitec Pivot did buy phosphate rock from a Moroccan company, and that some of that rock was sourced from the Western Sahara region.

"However, we believe that we conduct this trade legally," he said.

"We believe this is not an issue for us to resolve.

"The matter is being taken before the United Nations, and to the extent they take an interest in that matter, they are the ones that are responsible for resolving it.

"We believe that we do operate ethically as a company."

Shares in Incitec Pivot were eight cents lower at $3.40 on Wednesday.

News

Australia finally finished phosphate imports

The last remaining importer of phosphate rock from occupied Western Sahara in Australia has announced that it will no longer purchase the conflict mineral.

08 July 2025

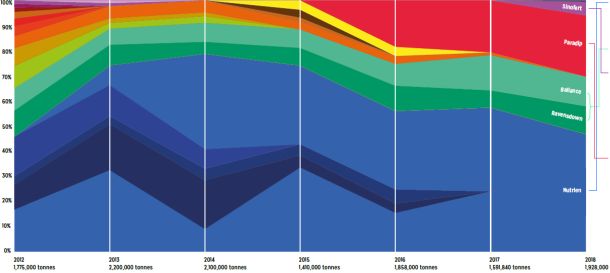

New report: Western Sahara phosphate trade halved

The export of phosphate rock from occupied Western Sahara has never been lower than in 2019. This is revealed in the new WSRW report P for Plunder, published today.

24 February 2020

WSRW to Incitec Pivot - 03.12.2019

03 December 2019

New report on Western Sahara phosphate industry out now

Morocco shipped 1.93 million tonnes of phosphate out of occupied Western Sahara in 2018, worth an estimated $164 million, new report shows. Here is all you need to know about the volume, values, vessels and clients.

08 April 2019