One of Total's biggest owners looking into the Sahara controversy

Norwegian national newspaper Aftenposten today wrote that Norway's government - owning two percent of Total - could possibly blacklist the company from its pension fund due to its operations in Western Sahara. Norway owns 2,5 billion USD of shares in the company.

Published 08 December 2012

Norway is one of Total's largest owners. Fuelled by its oil production, the Norwegian government is managing the world's biggest sovereign wealth fund, investing in companies all over the world.

The minimum ethical standards of the fund's management is set by the Norwegian Parliament, and an Ethical Council is appointed to counsel the Ministry of Finance in its decision to exclude companies violating the guidelines. In the past, several companies have been kicked out of the fund due to their operations in Western Sahara.

In a large story in Aftenposten today (the largest subscription based newspaper in Norway), one can read the first statements from Total defending its operations since the new licence was discovered.

"I expect the Ethical Council concludes that the Pension Fund should divest. Operating in Western Sahara is not compatible with the way we have decided to manage our oil wealth. I expect that the Ministry of Finances follow the advise given by the Ethical Council", stated Trine Skei Grande, leader of the Liberal Party of Norway, in a side story to the article.

[The below story appeared today in Aftenposten. Unofficial translation by WSRW]

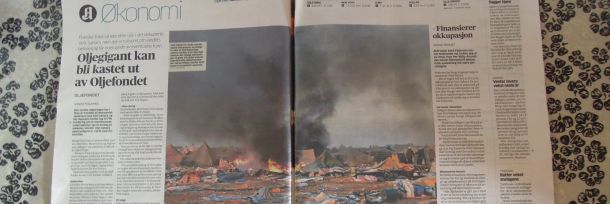

French oil company Total intends to search for oil in occupied Western Sahara, but it is doubtful whether the country’s population will ever enjoy the benefits of potential discoveries.

Oil giant could be thrown out of Norway’s Pension Fund

Aftenposten,

8 December 2012

The Norwegian government has for a number of years advised against all economic relations with Western Sahara, and has furthermore agreed with the UN’s legal opinion that Moroccan exploration and exploitation on the seafloor offshore Western Sahara most probably is in violation of international law.

Many states recognise the territory between Morocco, Mauritania and Algeria as occupied and annexed by Morocco. Including Norway.

“The owners of Total must immediately make contact with the management of the company to get all facts on the table. The activities in Western Sahara must stop and no agreement must be renewed or upgraded”, said Erik Hagen, director of the Norwegian Support Committee for Western Sahara.

The Petroleum Fund [The Norwegian Government’s Pension Fund, translator’s note] holds assets worth 14,3 billion kroners [2,5 billion USD, translator’s note] in the French company.

International Law

July last year, it was known that the Moroccan state oil company ONHYM had defined a new oil block on approximately 100.000 square kilometres, which in turn was given the name Anzarane Offshore. The block is off the southern parts of Western Sahara, and appears on a map published on ONHYM’s website.

Some sources said that Total’s agreement for Anzarane was signed in March 2012, while others indicate that the agreement was done already in December 2011.

“In either case, the agreement presuppose an investment from Total on at least to million US dollars in geological and geophysical studies”, Hagen explained, who was the first to write about the agreement in an article published by Western Sahara Resource Watch.

Hagen told that Total’s activities are in violation of international law.

“They furthermore contribute to uphold a conflict and thus behave unethically. Even though it would have been legal to create or to uphold international conflicts, it doesn’t make it right to do it. Total is looking for oil with no concern of the people of Western Sahara”, stated Erik Hagen.

“Not illegal”

Total confirms that the activity in Western Sahara, but does not want to elaborate.

“Total entered into a contract for oil reconnaissance and evaluation for the Anzarane block, located along the Atlantic coast of Africa. Total complies with all applicable laws, regulations and decisions of the UN and the EU, especially concerning the environment, competition and employment”, stated information officer Florent Segura at Total’s head quarters in Paris.

He underlines that it is not illegal to enter into contracts for reconnaissance and evaluation, as far as Total’s interpretation of UN.

The UN Security Council discussed the Western Sahara issue last week.

“UN special envoy to Western Sahara begs the international community for attention to the conflict. He said that one cannot accept status quo and he has placed the management of the natural resource as one of the key elements in the peace talks. In that context it is very destructive for the UN peace process that Total has signed the Anzarane-agreement”, said Erik Hagen.

Will complain

Erik Hagen told he has sent his updates to Norges Bank Investment Management (NBIM) which is managing the Petroleum Fund.

“We have also warned the [Norwegian] Ministry of Finances that if Total chooses to pursue its operations in Western Sahara, we will file a complaint stating that Total violates the ethical guidelines of the Petroleum Fund”, stated Erik Hagen.

If the Petroleum Fund were to divest from Total, it will probably be the biggest exclusion case ever, measured in value of the exclusion.

Does not exclude possibility of divestment from Total

The Ethical Council of the Norwegian Government’s Pension Fund will assess the issue of exclusion of Total shares. In 2005, the Fund divested from the oil company Kerr-McGee on the neighbouring block in Western Sahara. The reason was that Kerr-McGee was operating the oil search on Western Sahara’s continental shelf. Mr. Ola Mestad is leader of the Ethical Council. “The Fund owns to percent of Total, worth 14 billion kroners [2,5 billion USD]. The Council has been made aware of the new information that Total is said to be engaged in operations offshore Western Sahara”, said Ola Mestad.

News

Total paid near 4 million to occupier for oil block

The French company Total paid the Moroccan government near 4 million US dollars for the Anzarane exploration licence offshore Western Sahara, under illegal occupation.

08 October 2019

Total officially states it has left Western Sahara

"The contract was not extended in December 2015", company writes on website. It has also confirmed that it has "no plans" to return to the territory, which lies in the part of Western Sahara under Moroccan occupation.

21 June 2016

Norwegian investor excluded Total due to Western Sahara involvement

The Norwegian insurance company Storebrand has blacklisted both phosphate and oil companies involved in occupied Western Sahara. Among them are the French company Total, which are now back in from the cold after they withdrew from the territory.

25 March 2016

Total has left occupied Western Sahara

The French multinational oil company has announced that it is no longer pursuing oil search offshore Western Sahara. "More good news for the Saharawi people. We urge the remaining oil companies to follow suit", stated WSRW.

21 December 2015