There is a need to limit the risks of cadmium to the EU’s population, and to reduce the exposure to the heavy metal in our food. This was the conclusion of several extensive risk assessments and initiatives undertaken by the European Commission over the last few years.

Concerned about cadmium’s adverse health effects – particularly in terms of cancer -, the Commission in 2016 proposed a regulation for fertilizers made from phosphate rock, which stipulates the stepwise reduction of cadmium content to 20 mg/kg. Phosphate fertilizers are responsible for 60% of the current cadmium emissions to the Union’s soil and crops, a February 2017 study by the European Parliament’s Policy Department explains. The regulation will soon to be voted in the European Parliament and is to take effect from 1 January 2018.

However, the Moroccan government is currently working hard to prevent the EU from changing the regulations on the dangerous metal.

Morocco is the biggest exporter of rock phosphates in the world. Most of its phosphate rock and fertilizer products are exported from Morocco proper, but some is also exported from the territory of Western Sahara, which it holds under foreign occupation. The latest cargo of phosphate rock illegally exported from occupied Western Sahara to the EU, arrived on 8 October 2016 to Lithuania.

According to TelQuel, the Moroccan state phosphate company, OCP, has a sales figure of 32% in Europe. Since the proposed regulation would result in the nullification of that sales figure over time, OCP has unleashed an intense counter-lobby. OCP argues that there is not enough scientific proof to underpin the idea of limiting cadmium levels, and suggests the EU to even raise cadmium levels to 80 mg/kg, far higher than the suggestion from the EU Commission.

OCP has even instructed one of the law firms on its payroll, Dechert LLP, to lobby European Parliamentarians to convince them to vote against the proposed cadmium regulation.

On 11 May 2016, OCP sent a letter to the Commission, stating it disagreed with the proposal. OCP also lamented that “major fertilizer producers […] had not been consulted”. The irony is that OCP itself refuses to seek the consent from the people of Western Sahara upon plundering the territory’s phosphate rock.

OCP’s law firm Dechert LLP has been in the game of working for OCP for a long time. The company has primarily been involved in lobbying investors and importers around the world on the topic of Morocco's controversial trade in Western Sahara phosphate rock.

Part of Dechert's strategy is the use of undisclosed legal opinions that reportedly state that it is perfectly legal to import from Western Sahara, as the Saharawi people benefit from such trade. Saharawis, having an internationally acknowledged right to determine the status of the land and its resources, have never seen any of those opinions, despite having repeatedly asked for a copy.

The cadmium regulation proposed by the Commission for phosphate fertilizers suggests the step-wise adoption of ever lower concentrations of cadmium to curb the increasing exposure on the long term in Europe. Concretely, the concentration would be limited to 60 mg cadmium per kg phosphate rock when the regulation would enter into force. Three years later, the concentration level would be lowered to 40 mg/kg. And another 9 years later - so 12 years after the entry into force - the maximum concentration of cadmium would be 20 mg/kg.

The European Parliament (EP) is currently studying the Commission's proposal, and is expected to cast a vote in a few months from now. The EP Committee for Environment, Public Health and Food Safety has exclusive competence to amend the allowed cadmium limits set by the Commission's proposal. The Committee has appointed Elisabetta Gardina (Italy, EPP) as its rapporteur, tasked to study the matter.

The gradual accumulation of cadmium in pasture and farm lands has also been of concern in New Zealand and Australia. New Zealand is a main purchaser of Moroccan and Western Sahara phosphate rock. Australia was a key importer until recently, but two of the three importing companies have found other sources.

The phosphate rock managed by OCP – thus including the Western Sahara rock – are said to contain on average between 29.5 to 72,7 mg/kg. The EP Policy Department paints an even bleaker picture, citing levels of 38-200 mg Cd/kg P2O5.

According to the FAO, Morocco may possess over half of the world’s reserves of phosphate. That is, including the reserves that it exploit in Non-Self-Governing Territory of Western Sahara. As a UN fact-finding mission to Western Sahara concluded in 1975, if Morocco would succeed to exert control over its neighbouring country to the south, it would one day become the world’s leading exporter of phosphate. Later that same year, in defiance of international law and the UN Security Council’s Resolutions, Morocco invaded Western Sahara. To date, it exerts military control over large parts of the territory, including the phosphate mine of Bou Craa. OCP, Morocco’s state-owned phosphate company, exploits the Bou Craa mine as if it was entitled to do so. But it isn’t.

EU Member States disagree over toxic fertilizers

The European Parliament has voted to rein in toxic fertilizers that are high in carcinogene heavy metals. Morocco stands to lose a major market for its high in cadmium fertilizer products, which it exports also from occupied Western Sahara.

New report: Western Sahara phosphate trade halved

The export of phosphate rock from occupied Western Sahara has never been lower than in 2019. This is revealed in the new WSRW report P for Plunder, published today.

New report on Western Sahara phosphate industry out now

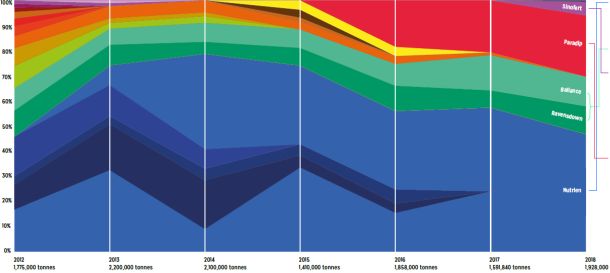

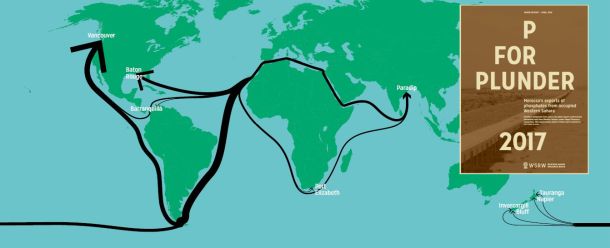

Morocco shipped 1.93 million tonnes of phosphate out of occupied Western Sahara in 2018, worth an estimated $164 million, new report shows. Here is all you need to know about the volume, values, vessels and clients.

New report on contentious Western Sahara phosphate trade

Morocco shipped over 1.5 million tonnes of phosphate out of occupied Western Sahara in 2017, to the tune of over $142 million. But the number of international importers of the contentious conflict mineral is waning, WSRW's annual report shows.