The Moroccan government has confirmed several green hydrogen projects totalling 20 GW of renewables and up to 8 million tonnes of derivatives - many planned in occupied Western Sahara.

Photo: Electricity lines just outside of Western Sahara's capital city El Aaiún.

Morocco’s controversial green hydrogen ambitions in its so-called "southern provinces" - occupied Western Sahara - have returned to the spotlight following new remarks by the country’s Minister for Energy Transition, Leïla Benali, during a session in the Moroccan parliament on 23 June 2025.

Addressing lawmakers in the Chamber of Representatives, Minister Benali presented an update on the country’s hydrogen strategy, known as the "Morocco Offer." She confirmed that several projects have been selected under this initiative, aiming to produce approximately 20 gigawatts of renewable energy, including approximately 10 gigawatts dedicated to electrolysis, to produce up to 8 million tons of green hydrogen derivatives such as ammonia, synthetic fuels, and low-carbon or green steel. The selected projects are expected to require around 63 millions cubic meters of water per year.

The Moroccan government promotes the "Morocco Offer" as a flagship initiative to attract global investment in green energy and position the country as a future exporter of green hydrogen. But most of the areas designated for project development lie within Western Sahara, outside of the international borders of Morocco. Western Sahara is a Non-Self-Governing Territory according to the United Nations, that has been under illegal Moroccan occupation since 1975.

In March 2025, the Moroccan government announced [or download] the names of investors selected to implement projects in what it refers to as the “three southern regions of the Kingdom.” These regions are Guelmim-Oued Noun, Laâyoune-Sakia El Hamra, and Dakhla-Oued Eddahab - the latter two corresponding almost entirely to occupied Western Sahara. Dakhla-Oued Eddahab covers the southern half of the territory, while Laâyoune-Sakia El Hamra spans the entire northern half, along with a small area in southern Morocco. Guelmim-Oued Noun, a smaller region within Morocco proper, slightly overlaps the border with Western Sahara in its easternmost part.

As such, about three-quarters of the land made available by the Moroccan government under the Morocco Offer is not in Morocco, but in occupied Western Sahara

The companies that were selected in March are:

- ORNX, a joint-venture of Ortus Power Resources (USA), Acciona (Spain) and Nordex (Germany). WSRW has identified plans for three green electricity production sites located in Boujdour, Dakhla and El Aaiún, as well as a site dedicated to storage and industrial processes near the port of El Aaiún – all these locations are in occupied Western Sahara. Our letters to Ortus, Acciona and Nordex, all sent on 10 April 2025 went unanswered.

- Taqa (UAE) and Moeve (formerly Cepsa, Spain) will produce green ammonia and industrial fuel. In March, Taqa Morocco reported that the selection of the consortium was “paving the way for negotiations on preliminary agreements to secure land and launch feasibility studies.” WSRW asked Taqa and Moeve on 28 July 2025 to clarify if their project will be implemented north or south of the internationally recognised border between Morocco and Western Sahara, but has not received a reply. Taqa’s intention of investing $10 billion in the construction of a 6 GW renewable plant for producing green hydrogen in Dakhla-Oued Eddahab was already clear in 2023. Cepsa, now Moeve, had previously been interested in constructing a hydroduct to import hydrogen from Morocco to its refinery in San Roque, Spain. At that time, Cepsa's CEO had expressed an interest in producing, first of all, ammonia and biofuels.

- Nareva (MA), subsidiary of the Moroccan royal holding Al Mada, will reportedly invest in a project encompassing ammonia, industrial fuel and green steel production. Nareva controls several wind farms in Western Sahara, and also has a partnership with GE Vernova for converting El Aaiún thermal power plant (99 MW) to a hydrogen-fueled plant.

- Acwa Power (Saudi Arabia) will establish facilities for green steel manufacturing. WSRW asked the company on 29 July 2025 to clarify in which country they’d set up the plant: Morocco or Western Sahara. No response was received at the time of publishing this article. Acwa Power has previously been active in Western Sahara through a contract with the Moroccan government, having developed the Noor Laayoune (80 MW) and Noor Boujdour (20 MW) solar plants.

- The consortium of United Energy Group (China) and China Three Gorges (China) will reportedly develop green ammonia production facilities. The exact location for the production site has not been officially confirmed. WSRW asked United Energy and China Three Gorges for clarifications in letters sent on 24 July 2025, but has so far not received a response.

In addition, two other projects are currently being developed under agreements signed in October 2024 with TotalEnergies and Engie. At present, there is no indication that the TotalEnergies project will be located in Western Sahara. Reports at the time described it as a preliminary land reservation agreement for a site near the Atlantic coast in the Guelmim-Oued Noun region - suggesting that the project would lie outside the boundaries of Western Sahara. Engie, meanwhile, does not respond to questions seeking clarifications how its monster-deal with Morocco's state-owned phosphate company OCP relates to occupied Western Sahara.

While the Moroccan government emphasises the climate and economic benefits of these projects, the people of Western Sahara, the Saharawis, have not consented to the use of their land and resources. International legal precedents, including rulings by the Court of Justice of the European Union and reports by UN Treaty Bodies, have pointed out that the Saharawi people ought to give their consent for any economic activity in Western Sahara.

"Developing green energy cannot come at the cost of a people’s fundamental rights," said Sara Eyckmans, coordinator of WSRW. "These projects risk laundering the occupation under a green pretext. Morocco has no legal mandate to develop natural resources or expand its infrastructure programmes in the territory it occupies. We call on all selected investors to ensure that their activities are in full compliance with international law and not used in cementing the ongoing occupation.”

The green hydrogen push further deepens Morocco’s large-scale efforts to exploit wind and solar resources in occupied Western Sahara.

Since you're here....

WSRW’s work is being read and used more than ever. We work totally independently and to a large extent voluntarily. Our work takes time, dedication and diligence. But we do it because we believe it matters – and we hope you do too. We look for more monthly donors to support our work. If you'd like to contribute to our work – 3€, 5€, 8€ monthly… what you can spare – the future of WSRW would be much more secure. You can set up a monthly donation to WSRW quickly here.

New report: Western Sahara phosphate trade halved

The export of phosphate rock from occupied Western Sahara has never been lower than in 2019. This is revealed in the new WSRW report P for Plunder, published today.

New report on Western Sahara phosphate industry out now

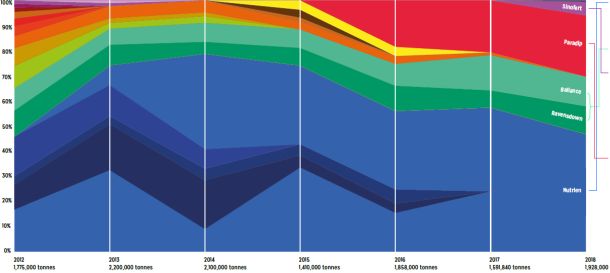

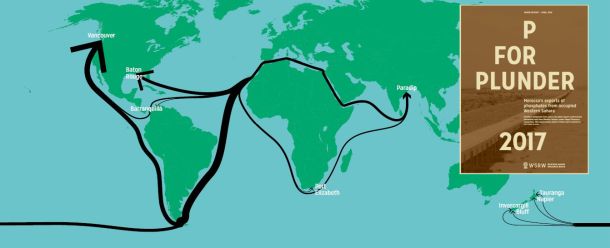

Morocco shipped 1.93 million tonnes of phosphate out of occupied Western Sahara in 2018, worth an estimated $164 million, new report shows. Here is all you need to know about the volume, values, vessels and clients.

New report on contentious Western Sahara phosphate trade

Morocco shipped over 1.5 million tonnes of phosphate out of occupied Western Sahara in 2017, to the tune of over $142 million. But the number of international importers of the contentious conflict mineral is waning, WSRW's annual report shows.

New report on global phosphate trade from occupied Western Sahara

Over 200 million dollars worth of phosphate rock was shipped out of occupied Western Sahara last year, a new report from WSRW shows. For the first time, India is among the top importers.