The blockchain computing company Soluna set on building a 900 MW wind farm in occupied Western Sahara, does not respond to questions from civil society.

Earlier this year, Moroccan media reported that the US company Soluna had been granted “green light” for its wind farm project in Dakhla, located along the mid-coast of occupied Western Sahara. Western Sahara Resource Watch (WSRW) contacted the company in March to ask whether it could confirm that news, but has still not received a reply four months later.

The blockchain computing company had announced its plans to construct blockchain computing infrastructure powered by a 900 MW wind farm in Dakhla in July 2018. At the time, the company still lacked the necessary funding, and was reportedly planning to raise $100 million in an initial coin offering to build the first 36 megawatts of turbines. WSRW wrote to Soluna’s parent company Brookstone Partners about the development in 2018, but they also did not respond.

However, the recent financial filings of another Brookstone subsidiary are now shedding some light on the case.

Mechanical Technology Inc (MTI), a Brookstone affiliate that specialises in testing and measuring materials, confirmed in March 2020 that the Moroccan Ministry for Energy has approved Soluna’s Dakhla project on 20 September 2019. MTI had submitted a range of financial documents pursuant to its creation of a wholly owned subsidiary, EcoChain Inc, in January 2020. As stated on MTI’s webpage, EcoChain “is developing a pilot cryptocurrency mining facility powered by renewable energy to integrate with the bitcoin blockchain network" – sounding eerily familiar to what Soluna is planning on doing.

And indeed on 18 June 2020, Soluna announced the commencement of its operation of a new 3 MW pilot cryptocurrency mining facility and ongoing research and development (R&D) in the town of Wenatchee, Washington. Soluna will operate the site on behalf of EcoChain, and will will engage in design laboratory activities to help plan the demand-response data centers Soluna will utilize in Dakhla.

In addition to the EcoChain partnership, MTI is investing US $ 500,000 in Soluna.

It would appear that Soluna needed a bail-out. At the time of MTI’s filing, Soluna reportedly had “outstanding payables to third-party contractors in an aggregate amount of approximately US $ 875,000”. These payables are “owed to service providers for i) development of Soluna's Moroccan wind site, ii) administration of Soluna's corporate legal, tax, and accounting, and iii) Soluna's marketing efforts”.

Some of the outstanding debts are a bit more detailed. Soluna owes legal fees to DLA Piper – a law firm that is also on Morocco’s payroll to defend its phosphate operations in occupied Western Sahara. Soluna also owes money to Fieldstone – an investment bank focused on renewable energy projects in Africa – though the investor has agreed to defer fees “until financial close of phase one of the AM Wind site” (referring to the Dakhla site, Ed). In addition, Soluna is behind on its pay-checks to one of its current Board members, former US Ambassador to Morocco Dwight L Bush, for “efforts related to Moroccan lobbying” to the tune of US$ 150,000.

Then there are some expenses pursuant to the purchase agreement with Altus AG, the German wind developer via which Soluna says to have obtained the “exclusive rights to develop the wind farm site going forward”. Altus AG is the former parent company of A.M Wind, which had started developing the site in 2009. Soluna acquired A.M. Wind in 2018. The MTI filings indicate that Soluna owes an overdue advance payment of €200,000, already due in June 2019. In addition, the purchase contract stipulated that development payments and success payments are owed in function of the development of the project. Altus AG as such stands to cash in €8 million, if Soluna is successful. While Altus has stated to WSRW that it has "discontinued all activities" and is "no longer active there", it apparently still has a financial connection to Soluna's Dakhla project.

In either case, it seems that the financial injections of MTI and of yet another Brookstone affiliate – MJT Park Investors, loaning Soluna US$ 912,238 – means that Soluna records a positive balance, intended primarily as deferred compensation principally for executives Dipul Patel, and John Belizaire. But “this is amount is not payable until July 2020 or Financial Close of Phase One of the Morocco Wind Project, whichever is later”.

Western Sahara Resource Watch is highly critical to the Soluna plans, and has called the company out on its factual mistakes and telling misrepresentations, including the company's unfounded assertions that Western Sahara has "the same status as the UN status of the British Virgin Islands or Cayman Islands” and that "an investment by Soluna in Morocco administered Western Sahara is allowed by the UN and supported by international law”. Soluna’s position papers on Western Sahara "appear to have been crafted to suit a clear purpose: avert attention from the legal and ethical problems that arise from its intention to do business on occupied land", WSRW wrote.

In 2016, WSRW wrote a report on Morocco's current and planned energy projects in the occupied territory.

Morocco pushes enormous green hydrogen plans in occupied Western Sahara

The Moroccan government has confirmed several green hydrogen projects totalling 20 GW of renewables and up to 8 million tonnes of derivatives - many planned in occupied Western Sahara.

French publicly-owned firm plans energy project in occupied Western Sahara

The French town of Dreux considers ignoring a ruling in the French courts and to engage with a controversial energy operation in occupied Western Sahara.

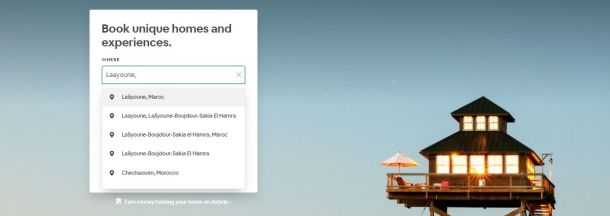

Airbnb places occupied Western Sahara within Morocco

The global match-maker of private accommodation has delisted providers in Israeli settlements and Crimea, but seem to apply different standards to similar situations of occupation. Saharawis object.

Bitcoins behind giant wind farm controversy in occupied Western Sahara

New York based private equity firm, Brookstone Partners, is reportedly set to build a highly controversial 900 megawatt wind farm in Dakhla, in the south of occupied Western Sahara.