For over 40 years, a Moroccan state-owned company has exported phosphate rock from occupied Western Sahara.

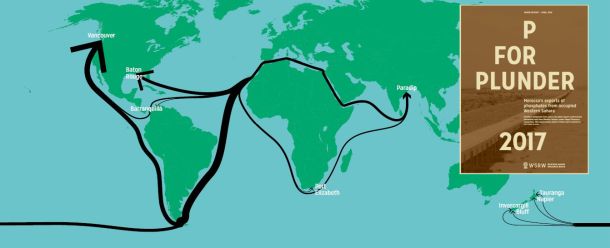

At the large Bou Craa mine, rocks of phosphate are placed on the world's longest conveyor belt and transported to the El Aaiún harbour, 100 kilometers to the west. From there, cargo vessels transport the phosphates from the occupied part of Western Sahara to importers overseas for fertilizer production. The industry has been providing Morocco with huge revenues since the start of the occupation.

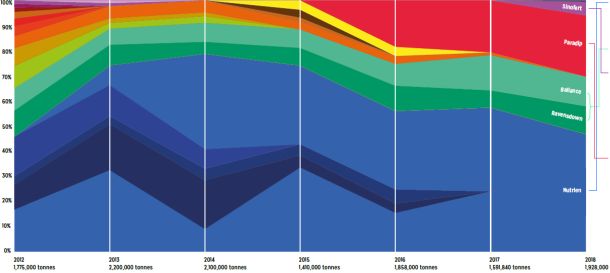

WSRW publishes annual overview reports on the controversial exports, based on our analysis of bulk ships departing from the port of El Aaiún. The report series - P for Plunder - has so far covered the trade for the calendar years 2012-2013, 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022, 2023, 2024. Some editions are published also in French and Spanish.

The Moroccan government operates the mine through its state-owned company OCP SA. One of its biggest clients the recent years is Paradeep, a subsidiary of OCP itself, located in India.

Two importers in New Zealand - Ravensdown and Ballance Agri-Nutrients - have been the most stable importers of the controversial conflict rock over the last decades.

There have been large shifts in the trade pattern since WSRW first started its annual reporting in 2012. The main development took place in December 2018, when the exports to US/Canada came to an end. Up to that point, the involved importer, Nutrien, had been responsible for purchasing 50% of the rock exported from Western Sahara. The North American exit led OCP to find new clients. As of 2023, there were exports to India, Mexico, New Zealand, as well as smaller shipments to Japan.

From 2022, a fertilizer factory and a new port are under construction in the occupied territory. This will probably increase Morocco's profits from the mine in the years to come.

Saharawis have consistently protested the trade.

OCP claims the trade is legal and leads to local employment. Its arguments are based on reports it has commissioned from lawfirms. The reports are then used by the importing companies - such as the ones in New Zealand - to defend the trade. However, all studies made by OCP are strictly confidential and not shared with the Saharawis. It will never be possile to assess their terms of reference, methodology and findings. WSRW considers it likely that aspects of international law and the right to self-determination are not considered in the studies, and that the only ‘stakeholders’ that the authors could have possibly been in contact with are Moroccan. No known Saharawi group has ever been asked about the trade.

In 2018, the High Court in South Africa ruled in the NM Cherry Blossom case, concluding that a bulk vessel transiting in South Africa on its way from Western Sahara to New Zealand, carried a cargo that had been illegally exported from the territory. The South African court referred to the conclusions of the European Court of Justice rulings on self-determination on Western Sahara. The UN Legal Counsel in 2002 stated that further exploitation of Western Sahara's resources would be in violation of international law.

A large number of previous importers have dropped their involvement with the Bou Craa phosphate rock, due to aspects of international law and human rights. For instance:

- In 2010, the US firm Mosaic announced it had stopped the imports from the territory, after being a customer of the Bou Craa mine for several years, “because of widespread international concerns regarding the rights of the Sahrawi people in that region."

- The Norwegian phosphate giant Yara declared that it is “….under present circumstances worthwhile to refrain from purchasing phosphate originating from Western Sahara”, and that the firm "hopes that the country will be liberated one day, and then the inhabitants will benefit if we can receive their phosphate quickly".

- Wesfarmers announced its termination of such imports in 2012, but without explaining why it stopped. Its investors had pressured the company for several years.

Innophos Holdings, a company on the New York Stock Exchange, announced in 2018 its decision to stop purchasing products from Nutrien's plant in Baton Rouge, Louisiana “as part of Innophos’ commitment to overall social responsibility and good corporate stewardship”. The decision was important in Nutrien's decision to stop the imports. Innophos, regretfully, resumed its imports in 2021 after the company had been off the stock-exchange. In 2022, it was the biggest importer.

Companies that have ended such long-term contracts include also Lifosa (Lithuania/Russia), Tripoliven (Venezuela), Monomeros (Colombia), Impact (Australia) and FMC Corp (USA/Spain).

The Australian company Incitec Pivot, which previously imported for decades, temporarily stopped the trade in 2016. In September 2022, the company received another cargo.

OCP bonds are traded at the Irish Stock Exhange, but have been excluded from the portfolios of numerous international investors. Several dozens of institutional investors are known to have divested from importing companies and to have removed OCP from their portfolios over the exports and trade. The Norwegian government pension fund alone has excluded several hundreds million dollars of shares, for ethical reasons.

The German/Spanish company Siemens Gamesa plays an important role in servicing the Bou Craa mine's infrastructure. Also, Worley and Caterpillar provide services to the operation. Important decisions were made in 2020 by both Epiroc, and Continental to not continue their supplies to the mining operations. Epiroc had supplied mining equipment, while Continental had supplied rubber systems for the conveyor belt.

Several shipping companies have renounced from continuing shipments from Western Sahara after learning about the ethical and legal aspects of the trade, such as Spar Shipping, Jinhui, Golden Ocean, Ugland, Arnesen, R-Bulk, LT Ugland and Belships. Danish shipping company Maersk made sure to terminate the former involvement of German group Dr.Oetker.

A UN delegation that visited the formerly known Spanish Sahara in 1975, as part of the de-colonialization of the territory, stated that “eventually the territory will be among one of the largest exporters of phosphate in the world”. According to their assessment, a free Western Sahara would become the second largest exporter, only beaten by Morocco. However, only a few months later, Morocco invaded Western Sahara. In recent years, the phosphate rock exports from Bou Craa have amounted to around 10% of Morocco’s total rock export. Bou Craa annual production has varied between 1 to 2 million tonnes the last decade, contributing substantially to finance the occupation of the territory and the depletion of the mine.

Morocco controls around three quarters of the phosphate reserves globally. Most of its exports take place from Morocco proper, while the Bou Craa mine in the occupied territory constitutes only a minor part of the OCP's overall operations. Yet, in a Saharawi perspective, the trade is of enormous importance.

Since you're here....

WSRW’s work is being read and used more than ever. We work totally independently and to a large extent voluntarily. Our work takes time, dedication and diligence. But we do it because we believe it matters – and we hope you do too. We look for more monthly donors to support our work. If you'd like to contribute to our work – 3€, 5€, 8€ monthly… what you can spare – the future of WSRW would be much more secure. You can set up a monthly donation to WSRW quickly here.

New report: Western Sahara phosphate trade halved

The export of phosphate rock from occupied Western Sahara has never been lower than in 2019. This is revealed in the new WSRW report P for Plunder, published today.

New report on contentious Western Sahara phosphate trade

Morocco shipped over 1.5 million tonnes of phosphate out of occupied Western Sahara in 2017, to the tune of over $142 million. But the number of international importers of the contentious conflict mineral is waning, WSRW's annual report shows.

New report on Western Sahara phosphate industry out now

Morocco shipped 1.93 million tonnes of phosphate out of occupied Western Sahara in 2018, worth an estimated $164 million, new report shows. Here is all you need to know about the volume, values, vessels and clients.

New report on global phosphate trade from occupied Western Sahara

Over 200 million dollars worth of phosphate rock was shipped out of occupied Western Sahara last year, a new report from WSRW shows. For the first time, India is among the top importers.